Kaboo

Reshaping consumer financial behavior using a preventative budgeting software.

Role

Product Designer

Timeline

Mar. 2024 - Jun. 2024

Team

3 Designers

2 Product Managers

Skills Leveraged

UX Research

Usability Tetsing

UI Design

Project Overview

Over Spring 2024, my team at Innovative Design at UCLA conducted research to validate product ideas and design decisions for Kaboo. While Kaboo's team had identified a market need for their preventative budgeting software, our work aimed to complement their efforts by gathering insights from a broader and diverse sample of target users.

This research focused on testing and validating Kaboo's current product features and user assumptions, providing valuable perspectives on budgeting habits, the effectiveness of gamification, and consumer psychology. By identifying these heuristics, we delivered actionable findings that supported Kaboo’s development process and optimized the app to better meet user expectations. I then took it upon myself to translate this research into a web-based solution platform.

I. THE CHALLENGE

How can we refine and redesign Kaboos user experience to better reflect consumer needs?

II. COMPETITIVE ANALYSIS

Let's take a look at other financial tech applications

In order to understand the current market, we conducted an analysis of some competitors that offer similar services. We also looked into products that have an element of gamification to learn what exactly brings users to complete a goal. This helped us identify potential features to incorporate into our product, as well as aspects to avoid.

III. HEURISTIC EVALUATIONS

Identifying competing usability inconsistencies

It was important to fully deep-dive and understand the specific value propositions that each competing app had and subsequently where it lacked an opportunity to provide value. Below is an example of 1 of 12 heuristic reports that we made on applications such as Mint, NerdWallet, and EveryDollar.

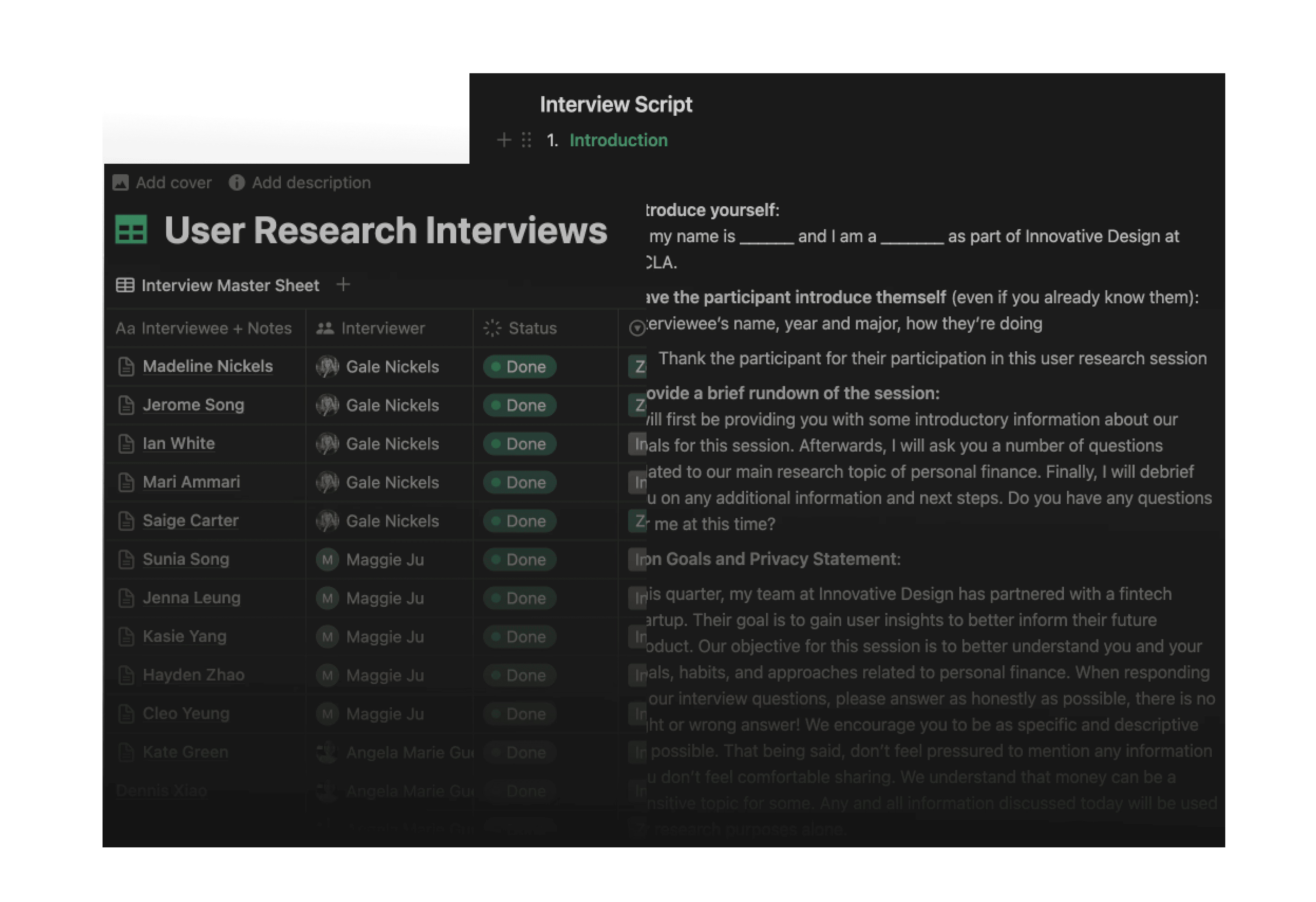

IV. CONTEXTUAL INQUIRY

Throwing the fishnet wide enough to understand user behaviors and patterns

It was important to fully deep-dive and understand the specific value propositions that each competing app had and subsequently where it lacked an opportunity to provide value. Below is an example of 1 of 12 heuristic reports that we made on applications such as Mint, NerdWallet, and EveryDollar.

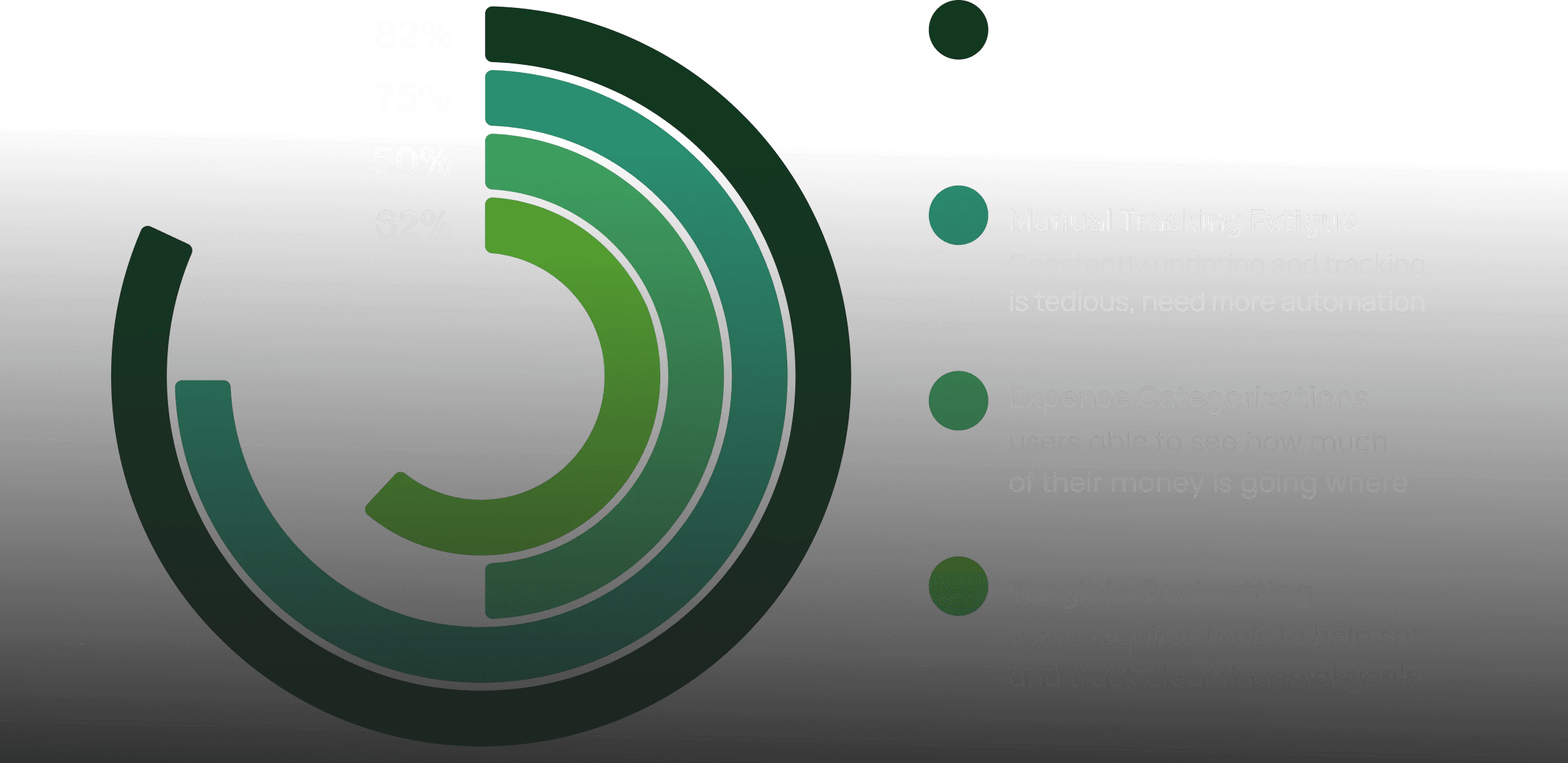

Here's a data visualization of some of the most popular responses and user needs mentioned.

V. AFFINITY MAPPING

Making cents of it all (pun intended)

With all of our data now centralized and gathered, we got to work in branching off the various themes and archetypes found throughout the interviews.

After grouping, these were the three most common groupings amidst all interview participants.

VI. USER PERSONA

Funneling 67 perspectives into one

After grouping the data from all interview respondants, we conglomerated all of the most common themes and unified them under one singular persona to better define how we could meet her needs.

VII. LOW FIDELITY DESIGNS

Fitting all this data onto a screen (literally)

Based on the research, I knew this project was going to have a very data-heavy dashboard, so I was excited to play around with the Apple-esque "Bento UI" minimalism theme. Here's one of the first beginning iterations of visualizing space.

VII. DESIGN SYSTEM

Trying out new design styles and techniques

Since the UI portion of this project was solo, I had a lot of creative freedom and used several plugins to integrat a clear, familiar design language that could be expanded upon.

VIII. FINAL PROTOTYPE

Introducing Kaboo

Taking the time to reflect

Connecting UX to UI; since this project was so research heavy, it was one of the first times I connected UX with UI, learning the power of understanding users and their behaviors on a deeper level.

Balance in design; finding the right balance between functionality and user-friendly design was crucial when thinking about how users would interact with certain financial features.

Edge cases; with this product, I was forced to look at it from all angles. Users could have irregular income patterns, multiple budgeting goals, etc. so it was my job to think through each edge case.